Fashion’s Inevitable Slow Growth

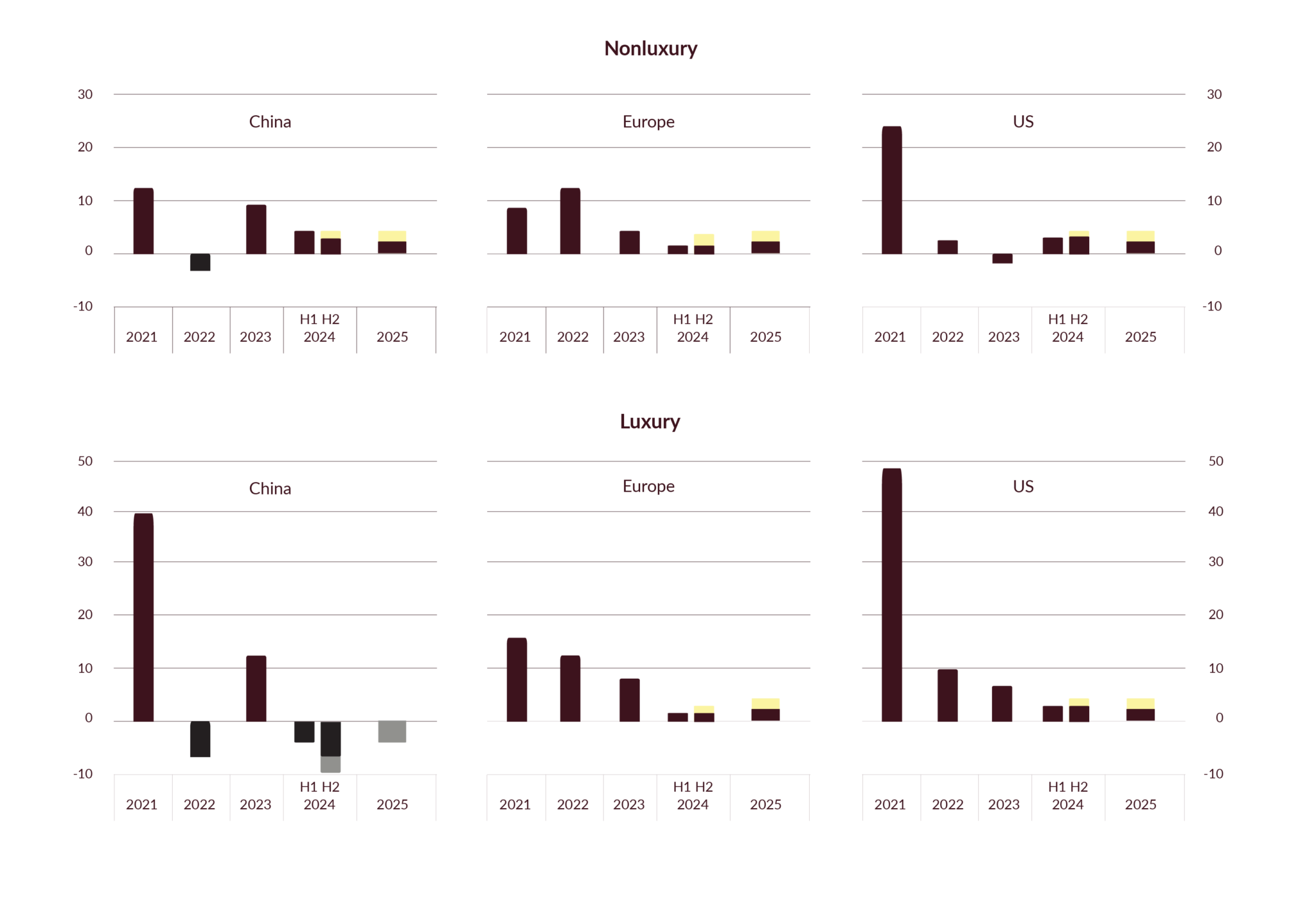

Stepping into 2025, the fashion industry finds itself in an uphill battle, as revenue growth crawls along in the low single digits.

by Anamaria Roa

The gloomy forecasts from last year have come true, thanks to a cocktail of economic uncertainty, regional gaps, and shifting consumer behaviors. Growth is still out there, but finding it feels like navigating a twisting, foggy maze. The industry’s sluggish pace of growth has confirmed last year’s pessimistic projections. The top risks are clear: waning shopper optimism, geopolitical unrest, and market unpredictability.

A Pessimistic Look: McKinsey’s State Of Fashion report reveals that only 20% of fashion leaders expect improved consumer sentiment, while 39% predict a further decline.

Consumer Fatigue: Shoppers are growing increasingly weary of rising prices, causing consumer fatigue to spread like wildfire. This trend of steady price increases is seen across a wide range of brands, from luxury labels to more affordable options. The iconic Chanel Medium Flap Bag stands out in this trend for several reasons, most notably its consistent annual price increase of 6-8% since 2012. Once priced around $5,000, it is now hovering well over $10,000. As a result, consumers are starting to move away from brands that keep raising prices and turning to more affordable alternatives that offer more value for their money.

Volume Over Price: Consumer demand is sparking change, and brands are paying attention—shifting their focus to boosting volume growth.

Pricing Pressure Eases: Compared to 2024, 17% fewer executives plan price increases, signaling a shift in focus.

Volume-Driven Gains: Nearly two-thirds of executives project low single-digit growth, driven by unit sales rather than higher prices.

This tug-of-war between price sensitivity and volume growth shows that brands need to rethink their game plan.

Predict, Plan, Prioritize

In a landscape defined by caution, fashion leaders are doubling down on strategies to stand out and capture emerging opportunities. Here are the key areas of focus:

- Differentiate to Stand Out: To stand out in an overcrowded marketplace, brands are embracing creativity and innovation. Whether through bold designs, new customer experiences, or targeted niche markets, differentiation is key.

- Localization Strategies: Emerging markets hold significant potential, with India leading the charge. Half of the surveyed executives are tailoring pricing, fulfillment, and product assortments to better connect with local consumers. Localization strategies like these ensure brands remain relevant across diverse regions.

- Broad Appeal: Inclusivity is no longer optional. To capture a wider audience, 65% of fashion executives plan to offer products spanning a range of price points. This strategy also helps balance inventory management with market demand.

- Decreased Focus on Cost-Cutting: Cost-cutting has taken a backseat to investment. Over 85% of executives expect low single-digit increases in operating costs, channeling funds into AI, digital innovation, and other growth-focused initiatives.

- Sustainability Steps Back: Sustainability, once a centerpiece of industry strategy, has been overshadowed by the urgency to differentiate and capture market share. While efforts to adopt sustainable practices continue, executives are focusing on immediate growth opportunities, like new designs and improved customer experiences.

As the industry treads through 2025, success will remain on the ability to balance short-term pressures with long-term vision. For fashion brands, the focus must remain on adaptability, innovation, and the courage to change. Growth may be slow, but opportunities for success are there, for those ready to take the leap.