The Art Market in Flux: Europe’s Influence

Art has always been more than a commodity. It’s a mirror to society, an investment in culture, and a declaration of values. But what happens when the world itself is in flux?

by Merve Eker

The Art Basel and UBS Survey of Global Collecting 2024 report reveals a market navigating uncertainty with innovation, resilience, and a steadfast commitment to what truly matters. Europe, long a custodian of the art world’s heritage, is charting the course forward.

The New Reality of Wealth in Art

The global art market is recalibrating. Ultra-high-net-worth collectors—the backbone of the industry—have tightened their purse strings, with spending down 32% to an average of $363,905 in 2023. Yet, the stability of mid-tier buyers shows that the appetite for art has shifted.

In Europe, this translates to careful recalibration rather than retreat. Switzerland remains a quiet giant, anchoring the market with its stability and role in cross-border transactions. Meanwhile, the UK’s slight contraction of 8% reflects caution, but not crisis.

Paris: The Beating Heart of Change

Paris is thriving. With Art Basel Paris expanding and the Grand Palais reopening in grandeur, the city is cementing its place as the contemporary art capital. In a year when auction houses worldwide saw a 26% decline in sales, Paris reminds us that art is as much about the experience as the transaction.

The Generational Shift

Art is becoming a bridge between generations. With $85 trillion in wealth expected to change hands in the coming decades, Europe’s collectors are redefining inheritance. In France and Germany, family collections are cultural artifacts. Whether donated to institutions or carefully preserved, these pieces carry stories of the past into the future.

It’s a striking paradox: art’s value lies in its timelessness, yet its relevance is constantly renewed with each passing generation.

Emerging Artists: The Vanguard of Tomorrow

In a market often dominated by established names, the rise of emerging artists is a quiet revolution. Over half of high net worth individual’s (HNWI) art budgets in 2023 and 2024 went to early-career creators, up from 44% just a year prior.

Berlin and Amsterdam are at the epicenter of this movement, fostering a new wave of talent. These cities remind us that art is an investment in ideas, voices, and the future of creative expression.

Female artists now make up 44% of high-net-worth collections, a leap from 33% in 2018. Europe leads the way, with exhibitions in London and Vienna showcasing works that were long overlooked.

A Medium for Every Mood

While paintings continue to dominate collections, the growing popularity of works on paper signals a shift in tastes. More than half of collectors acquired these pieces in 2023 and early 2024, drawn to their versatility and accessibility.

Cities like Vienna and Paris are at the forefront of this trend, celebrating the subtle depth of this medium. It’s proof that great art doesn’t always come with a towering price tag.

The Future is Experiential

Generational divides are reshaping how art is consumed and valued. Gen X remains the biggest spender, but millennials and younger collectors are bringing fresh energy to the market. Scandinavia and Southern Europe, in particular, are embracing experiential art and innovative media.

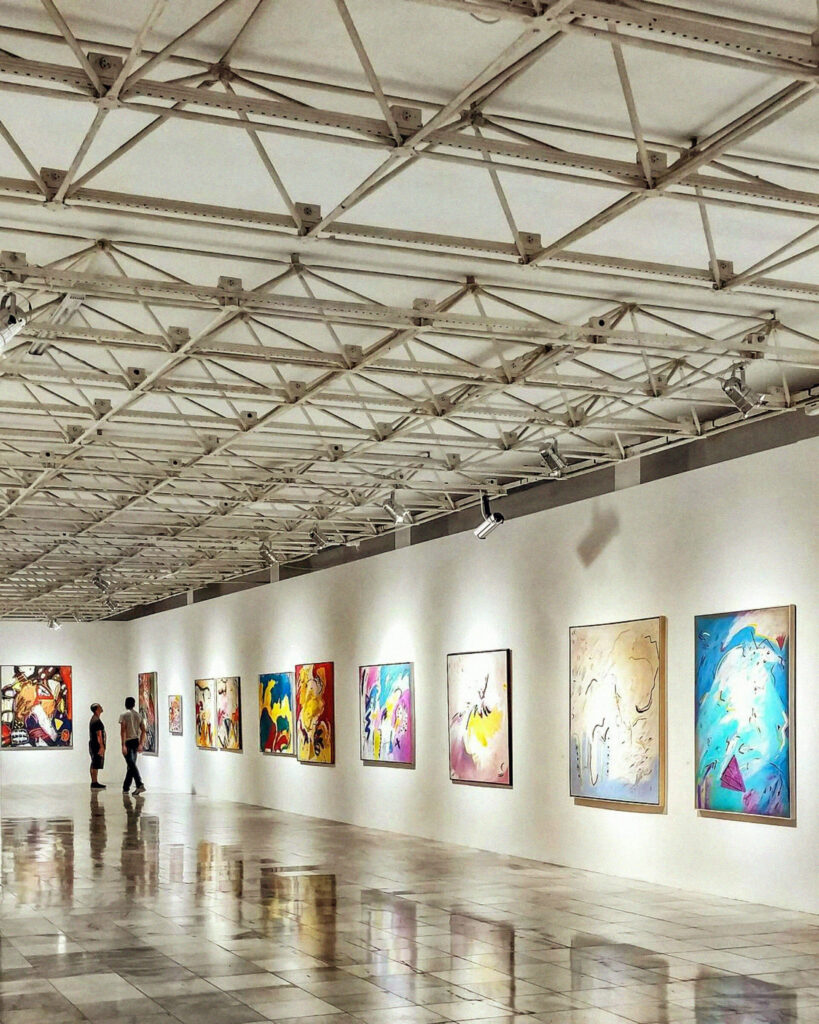

Art Fairs: Where Culture Meets Commerce

Art fairs are evolving into cultural landmarks. TEFAF Maastricht and Art Basel’s European editions are immersive experiences. Spending at fairs climbed to 41% in early 2024, reinforcing their status as vital hubs where collectors connect with art—and each other.

In Europe, where gallery culture remains king, fairs offer a balance of tradition and transformation. They’re places where the tactile, human side of art collecting thrives. Europe, with its rich history and forward-thinking ethos, remains at the heart of this dynamic world. From championing emerging voices to preserving legacy, the continent is both anchor and compass.

In a time of change, Europe’s art market is setting the stage for what comes next.